For most people, their first home isn’t their dream home. It starts off nice enough. But as time goes by and your family grows, starter homes tend to get a little . . . cramped.

But don’t hate on your current home too much. Because while it gave you a safe and dry place to lay your head at night, it was also setting you up to own your dream home someday.

We’ll show you how it all works and walk you through the steps that’ll get you in your dream home—one you can actually afford!

How to Get Your Dream Home in 5 Steps

Here are the steps:

- Follow the Financial Basics

- Find Out How Much Equity You Have

- Set Your New Home-Buying Budget

- Find the Right Dream Home for You

- Be Picky and Patient

Now let’s cover each step in more detail.

Step 1: Follow the Financial Basics

First thing’s first—you have to get out of debt, get on a budget, and build up an emergency fund of 3–6 months of expenses. Sounds pretty basic, right? If you haven’t completed these steps, then you’re not ready to upgrade to your dream home . . . yet.

Now, when you’ve got house fever, it can be hard to focus on paying off debt or saving an emergency fund before you upgrade your home—especially when you’re feeling the pressure of rising home prices and interest rates.

But whether it’s your second or third house, you should only buy a home when you’ve covered the financial basics we mentioned above. Then you’ll be ready to start the journey toward owning your dream house.

And that journey starts with your home equity. What’s equity? Well, we’re glad you asked . . . that brings us to the next step.

Step 2: Find Out How Much Equity You Have

Home equity is a pretty simple concept: It’s your current home’s value minus whatever you still owe on your mortgage.

See, in most cases, your home’s value increases over time. Similar to other long-term investments (like retirement accounts), homes gradually increase in value. There have been periods of ups and downs in the market to be sure, but the value of real estate has consistently gone up. According to the St. Louis Federal Reserve, the average sale price of a home has increased over 2,300% from 1965 to 2023! And in the last ten years (2013 to 2023), there’s been a 68% increase.1 As your home increases in value, so does your equity. In real estate terms, this is called appreciation.

Other factors that increase your home’s equity include:

- Added value: Home improvement projects like adding square footage, updating fixtures and appliances, or even just slapping on a new coat of paint can add value to your home.

- Mortgage paydown: Paying down your mortgage not only gets you out of debt faster, it also builds your equity. The less you owe on your home, the more equity you have.

The amount of equity you have gives you a pretty good idea of how much money you’ll end up with after selling your house. You can use that money to make a hefty down payment and cover the other costs that come with buying a home.![]()

Find expert agents to help you buy your home.

So, how do you determine your home’s value? Well, you can get a ballpark estimate on real estate websites like Zillow, ask a trusted real estate agent to perform a competitive market analysis (which they’ll do anyway if they’re helping you sell your house), or get a professional appraisal.

Finding out your home’s equity will involve a little math, but it’s third-grade-level stuff, so don’t sweat it.

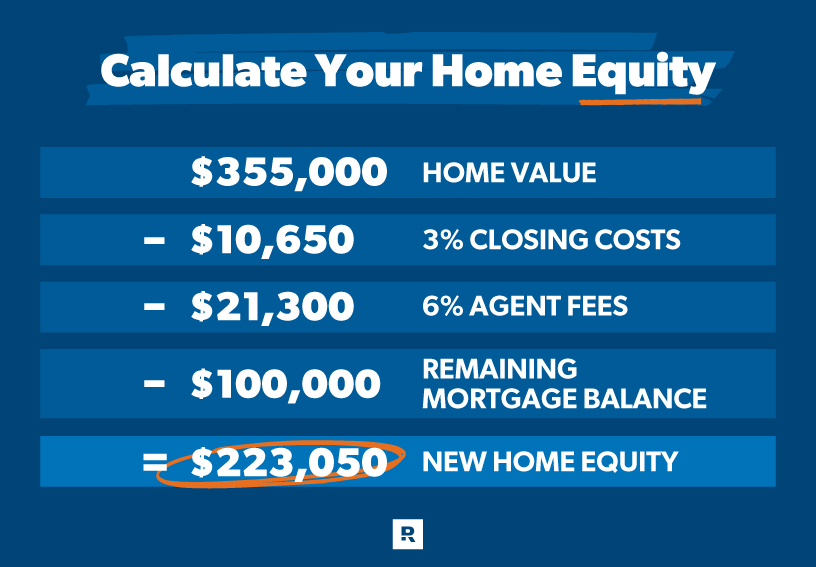

Here’s what we mean. Let’s say your home’s current value is $355,000. When you sell that house, you’ll have to pay for between 1–3% of the sale price in closing costs, another 6% in fees for the real estate agent who helped you sell it, and whatever’s left to pay off on your mortgage.

That means you can estimate clearing over $223,000 from selling your house. That’s a killer down payment on your dream home! And if your home is paid off, that’s even more money to put down and use to pay for things like repairs and moving expenses.

Step 3: Set Your Dream Home Budget

Once you know how much you’ll clear from the sale of your home, you can start making a budget for your dream home.

The key to owning your dream home (instead of it owning you) is to keep your mortgage payment to no more than 25% of your take-home pay on a 15-year fixed-rate mortgage, along with paying a down payment of at least 20% to avoid private mortgage insurance (PMI). Never get a 30-year mortgage even if the bank offers it (and they will). You’d pay a fortune in interest—money that should go toward building your wealth, not the bank’s.

So, let’s say your take-home pay is $4,800 a month. That means your monthly mortgage payment shouldn’t be any bigger than $1,200. By the way, that 25% figure should also include other home fees collected every month with the mortgage payment like homeowners association (HOA) fees, insurance premiums and property taxes.

Plug your numbers into our mortgage calculator to see how much house you can afford.

And don’t forget to budget for all those other costs that come with the home-buying process in addition to your closing fees—things like moving expenses and any upgrades or repairs you might need to make. You don’t want these hidden costs to catch you off guard or drain your emergency fund.

Step 4: Find the Right Dream Home for You

This is where things get real. After all your hard work building up your equity (and doing a lot of math—don’t forget that), you’re finally ready to start the house hunt. Woo-hoo!

But don’t lose focus. Stay zoned in by making a list of features that make a home fit your budget, lifestyle and dreams—and stick to it throughout your house hunt. Here are a few ideas to get you started.

- Don’t compromise on location and layout. If you plan to be in this home for the long haul, an out-of-the-way neighborhood or a wacky floor plan is a deal breaker. Look for a community and layout that’ll suit your lifestyle now and for years to come.

- Think about how much space your family needs. While your budget has the final say about how much home you buy, you’ll want your dream home to fit your family’s needs through different life seasons.

- Consider the school districts. If you have or want kids, the quality of the nearby school districts is probably already on your mind. But even if you don’t have kids or you’re retired, keep in mind that having good schools nearby could increase your home’s value.

- Look for a house that’ll grow in value. Are home values rising in the area? Is the number of businesses going up? These factors can help you figure out whether your dream home will turn into a good investment.

- Count the costs. Want that fancy master bathroom with the multiple showerheads and the Jacuzzi tub? Be clear on what’s a must-have and what’s nice to have. And don’t forget, upgraded features like that will make your dream home more expensive.

Step 5: Be Picky and Patient

We know you’re anxious to get into those new digs, but be patient. Wait for the right house at the right time. Don’t spend your money on a less-than-ideal home just because you’re tired of looking.

The key is finding a good real estate agent who understands your budget and refuses to settle for “good enough.” They’re as committed to your dream as you are and will have your back throughout the entire process, no matter what it takes.

In addition to teaming up with a great real estate agent, you can take a couple of extra steps to make sure you’re ready to strike as soon as the right home comes up:

- Get preapproved for a 15-year fixed-rate mortgage. Having preapproved financing is a green flag for sellers—especially in multiple offer situations. And because this puts most of your information in the lender’s system, you’ll be on the fast track to closing once your offer is accepted.

- Offer earnest money with your bid. Earnest money is a deposit to show you’re truly interested in a home. Usually it’s 1–2% of the home’s purchase price and it’s applied to your down payment or closing costs. Even if the deal falls through, you can almost always get most of it back.

Find a Real Estate Expert in Your Local Market

Now, you might be thinking you have some work to do before you’re ready to find your dream home. Or you may be realizing your years of hard work are about to pay off! Regardless, if you follow these steps, you’ll find the house you’ve always wanted and avoid a purchase you’ll regret.

Once you’re ready, connect with one of our RamseyTrusted real estate agents. These are high-performing agents who do business the Ramsey way and share your values so you can rest easy knowing the search for your dream home is in the right hands.

Find the only real estate agents in your area we trust, and start the hunt for your dream home!

All My Left Socks Started Disappearing – When I Found Out Why, My Heart Stopped

Dennis, a single dad still mourning his wife, is baffled when one sock from all his pairs mysteriously starts vanishing. Frustrated and desperate for answers, he sets up a nanny cam. What he discovers sets him on a heart-pounding journey through his quiet neighborhood.

I know what you’re thinking: who makes a big deal about missing socks, right? Trust me, if you’d been in my shoes (pun absolutely intended), you would’ve done the same thing.

Shoes and socks on a man’s feet | Source: Pexels

Because when you’re a single dad trying to keep it together, sometimes the smallest things can drive you completely up the wall.

It started with just one sock. A plain black one, nothing special. I assumed it got eaten by the dryer, like socks tend to do.

But then another disappeared the next week. And another.

I don’t know about you, but after the fifth missing sock, even the most rational person would start getting suspicious.

A man looking puzzled in a laundry room | Source: Midjourney

“Dylan?” I called out one morning, rifling through the laundry basket for what felt like the hundredth time. “Have you seen my other gray sock?”

My seven-year-old son barely looked up from his cereal. “No, Dad. Maybe it’s playing hide and seek?”

Something in his voice made me pause. Dylan had always been a terrible liar, just like his mother was. Sarah could never keep a straight face when trying to surprise me, and Dylan had inherited that same tell — a slight quiver in his voice that gave everything away.

A man sorting through laundry in his kitchen | Source: Midjourney

“Are you sure about that, buddy?” I pressed, studying his face.

He shrugged, suddenly very interested in his Cheerios. “Maybe check under the couch?”

I did check under the couch, and everywhere else. Behind the washing machine. In every drawer, basket, and bin in our house. I found $5 in spare change and some missing Lego blocks, but no socks.

Coins on a table | Source: Pexels

The mystery of the vanishing socks was driving me crazy. I even started marking pairs with little dots to make sure I wasn’t imagining things.

You’re probably wondering why I didn’t just buy new socks. Maybe that would have been the sensible thing to do, but most of the missing socks were novelty socks my wife had given me.

I tried wearing my smiling banana sock with the dancing cat sock, but it just didn’t work. Call me sentimental, but the thought of never being able to wear the silly socks my wife gave me again hurt my heart.

A man wearing funny novelty socks | Source: Pexels

“This is ridiculous,” I muttered to myself one evening, staring at a pile of perfectly good socks without matches.

That’s when I remembered the old nanny cam we’d used when Dylan was a baby. It took some digging, but I found it in the garage, buried under a box of Sarah’s old things.

My heart clenched a bit when I saw her handwriting on the box (“Baby’s First Year”). Funny how grief sneaks up on you in the smallest moments, isn’t it? But I had a sock thief to catch, and I wasn’t about to let memories derail my investigation.

A man searching through boxes stored in a garage | Source: Midjourney

Setting up the camera in the laundry room felt silly, but I was beyond caring. I deliberately hung up three pairs of freshly washed socks and waited.

The things we do as parents, I swear. If someone had told me five years ago, I’d be setting up surveillance to catch a sock thief, I would’ve laughed them out of the room.

The next morning, I nearly spilled my coffee in my rush to check the footage. What I saw made my jaw drop. There was Dylan, tiptoeing into the laundry room well before sunrise, handpicking one sock from each pair and stuffing them into his backpack.

A boy’s hand on a backpack | Source: Midjourney

“What in the world?” I whispered to myself.

Now, here’s where I had to make a decision. The rational thing would have been to confront Dylan right there and then. But something held me back.

Maybe it was curiosity, maybe it was instinct, but I wanted to see where this weird sock saga would lead.

I set a trap for my sock-stealing son so I could discover what he was doing with all my socks.

A determined man sitting in his kitchen | Source: Midjourney

I hung more clean socks in the laundry room and kept a close eye on the nanny cam. I watched Dylan take the socks, but when he left the house, I followed him.

My heart raced as I tailed him at a distance, trying to stay inconspicuous. He turned onto Oak Street, a road I usually avoided because of the abandoned houses. Except, apparently, they weren’t all abandoned.

You know that moment in horror movies where everyone’s screaming at the screen, telling the character not to go into the creepy house? That’s exactly how I felt watching Dylan walk right up to the most decrepit one on the block and knock on the door.

A badly maintained house | Source: Midjourney

And when it opened, and he went inside? Well, let’s just say my Dad instincts went into overdrive.

“Oh heck no,” I muttered.

Every stranger danger warning bell in my head was ringing as I ran up the cracked walkway and burst through the door without thinking.

Not my proudest moment of rational decision-making, I’ll admit, but what would you have done?

A man’s hand pressing against a weathered front door | Source: Midjourney

I stopped dead in my tracks.

The scene before me was nothing like I’d feared. An elderly man sat in a wheelchair by the window, wrapped in a worn blanket. Dylan stood in front of him, holding out a familiar-looking bag.

“I brought you some new socks,” my son said softly. “The blue ones have little anchors on them. I thought you might like those since you said you were in the Navy.”

The old man’s weathered face cracked into a smile. “Army actually, son. But I do like anchors.”

An elderly man in a wheelchair smiling | Source: Midjourney

I must have made some sort of sound because they both turned to look at me. Dylan’s eyes went wide.

“Dad! I can explain!”

The old man wheeled himself around. “You must be Dennis. I’m Frank. Your boy here has been keeping my foot warm for the past month.”

He smiled as he lifted the blanket, revealing that he had only one leg. Now, the one missing sock from each pair made sense!

A man looking at something with raised eyebrows | Source: Midjourney

“He’s been keeping me well-supplied with apples, too,” Frank added. “And I can’t tell you how much I appreciate it. I’m a retired army vet and I’ve been alone here for a while. I watch the kids walking to school and back every day, but your boy is the first one to show me kindness.”

“We all saw him at the window,” Dylan blurted out. “Tommy and Melody said he was a scary ghost, but I knew they were lying. He’s just lonely and cold, and Mom always said that new socks make people feel better, remember? She’d buy us funny socks whenever we were sad.”

An emotional boy speaking to someone | Source: Midjourney

You know those moments that just knock the wind right out of you? This was one of them. Whenever one of us had a bad day, Sarah would come home with the most ridiculous socks she could find.

“Because life’s too short for boring socks,” she’d always say.

Frank cleared his throat. “Dylan’s been visiting me every day since then. First company I’ve had in years, if I’m being honest. My own kids left the country years ago. They send me money sometimes, but don’t visit much.”

A sad man in a wheelchair | Source: Midjourney

“I know I should have asked first, but I was worried you’d tell me I couldn’t see him because he’s a stranger.” Dylan said, looking at his shoes. “I’m sorry I took your socks, Dad.”

I crossed the room in three steps and pulled my son into a hug.

“Don’t apologize,” I whispered, my voice rough. “Your mom would be so proud of you. I’m proud of you.”

A man speaking to his son | Source: Midjourney

“He’s a good boy,” Frank said quietly. “Reminds me of my Jamie at that age. Always thinking of others.”

The next day, I took Dylan shopping. We bought out half the fun sock section at Target — wild patterns, crazy colors, the works.

I mean, if you’re going to be a sock fairy, you might as well do it right, wouldn’t you say? Dylan’s face lit up when I told him we could deliver them together.

A man and his son leaving a store | Source: Midjourney

Now, we visit Frank regularly. I help him with home repairs he can’t manage anymore, and Dylan regales him with stories about school.

Sometimes we bring him dinner along with the socks, and he tells Dylan war stories that somehow always end up being about kindness in unexpected places.

My sock drawer is still ridiculously full of single socks, but I don’t mind anymore. Every missing sock is a reminder that sometimes the biggest hearts come in the smallest packages, and that my seven-year-old son might understand more about healing broken hearts than I ever did.

A dresser in a bedroom | Source Pexels

You know what’s funny? Sometimes I look at those mismatched socks and think about how life works in mysterious ways.

Leave a Reply